Contact Information

D 203, NR Orchid Gardenia, Mestri Palya, St. Anns Church, Rachenahalli, Bangalore.

P.O.Box: 560077.

Have any Questions?

(+91) 9901765060

Mail us today

connect@ratocommunications.in

Get in Touch

Contact Information

D 203, NR Orchid Gardenia, Mestri Palya, St. Anns Church, Rachenahalli, Bangalore.

P.O.Box: 560077.

Get in Touch

Contact Information

D 203, NR Orchid Gardenia, Mestri Palya, St. Anns Church, Rachenahalli, Bangalore.

P.O.Box: 560077.

Branding After a Merger: How to Build Brand Equity

March 14, 2025

Reuben Rato

No Comments

Mergers and acquisitions are often hailed as business victories, signaling growth, market expansion, and financial strength. But beyond the financial impact, brand integration is the real test of a successful merger.

Two companies, each with its own identity, customer base, and market positioning, now have to coexist. The challenge isn’t just operational, it’s deeply psychological and strategic.

Customers who have trusted a brand for years might feel alienated if the transition is abrupt or confusing. Employees might struggle with cultural clashes or an unclear brand vision. If handled poorly, a rebranding decision can lead to customer churn, brand dilution, and market confusion.

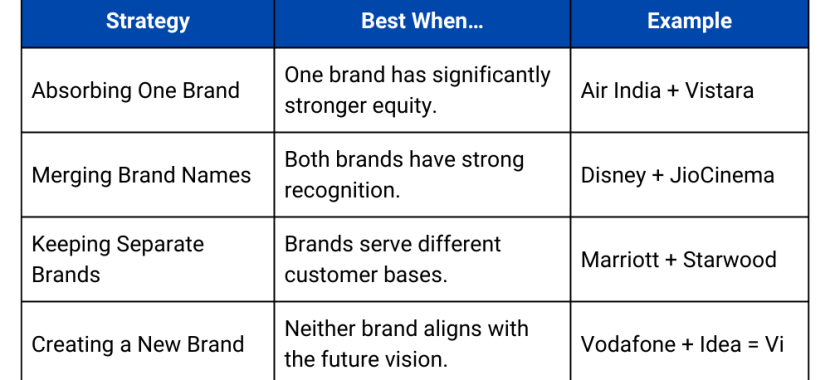

So, how do companies decide which branding approach to take? Do they retain one dominant brand, merge names, keep them separate, or create a new identity altogether?

One key factor lies at the core of this decision: brand equity. Companies must evaluate brand equity before deciding how to proceed with a rebrand.

What is Brand Equity and Why Does It Matter?

Brand equity is the value a brand holds in the minds of consumers, employees, and the market. It’s not just about a recognisable logo or a catchy slogan, it’s about the trust, perception, and emotional connection a brand has built over time.

Consider why consumers are willing to pay a premium for Apple over a lesser-known tech brand or why people remain fiercely loyal to Nike despite numerous competing sports brands. That’s brand equity at work.

A strong brand can influence customer purchase decisions, loyalty, and financial performance.

In the context of a merger or acquisition, understanding brand equity is critical because it helps determine:

- Which brand (if any) should remain dominant?

- How much value does each brand contribute to customer loyalty?

- Will rebranding help or hurt customer trust?

- Should brands merge, remain separate, or be rebranded into something new?

The Three Core Components of Brand Equity:

Brand equity isn’t just an abstract concept—it can be measured and built strategically. Here are the three key components:

Brand Awareness

How well do consumers recognise and recall the brand? A well-known brand has substantial equity because people are more likely to consider it during purchase decisions.

Example: Coca-Cola vs. a generic soda brand, Coke’s high awareness gives it a competitive edge.

Brand Perception & Associations

What emotions and ideas come to mind when people think of the brand? Positive brand associations lead to higher consumer trust and preference.

Example: Tesla is associated with innovation and sustainability, while Volvo is linked to safety.

Brand Loyalty & Customer Retention

Do customers repeatedly choose the brand over competitors? High brand equity means consumers won’t easily switch when new competitors arise.

Example: Despite the rise of Android phones, Apple retains one of the most loyal customer bases.

Why Brand Equity Matters in Mergers & Acquisitions

During a merger, brand equity becomes a strategic asset. Companies must evaluate which brand has stronger equity and determine how to preserve or enhance it during the transition.

If one brand has significantly higher equity than the other, absorbing the weaker brand makes sense. (Example: Air India keeping its name while adopting Vistara’s premium elements.)

If both brands have strong recognition in different markets, a name merger retains their combined audience. (Example: Disney + JioCinema combining global and local strengths.)

If both brands serve distinct customer bases, keeping them separate prevents alienation. (Example: Marriott and Starwood operating as distinct hotels under one corporate umbrella.)

If neither brand aligns with the future vision, creating a fresh brand can reset perceptions. (Example: Vodafone and Idea merging into Vi.)

Brands that manage equity carefully will retain customer trust, avoid confusion, and emerge stronger from the merger.

Strategy 1: Absorbing a Smaller Brand into a Dominant One

Case Study: Air India + Vistara

Mergers in the airline industry are particularly tricky. Passengers are intensely loyal to their preferred carriers, and any drastic changes, whether in branding, service, or customer experience, can lead to uncertainty and dissatisfaction.

When Tata Group acquired Air India and Vistara, it faced a critical branding decision:

Air India is India’s flagship national carrier, with a storied past. However, it has suffered from years of operational inefficiencies, financial struggles, and declining customer trust.

Vistara, a joint venture between Tata and Singapore Airlines, had quickly built a reputation for premium service, customer satisfaction, and operational excellence.

Instead of keeping both brands alive, Tata absorbed Vistara into Air India, retaining the Air India name while incorporating Vistara’s best elements to rebuild and reposition the airline as a world-class premium carrier.

Why This Strategy?

Air India’s strong legacy and global recognition

Despite its challenges, Air India is an internationally recognised brand with decades of history. Retiring it in favor of Vistara would have erased its heritage and global brand equity.

Vistara’s premium positioning strengthens Air India’s rebrand

Rather than just a cosmetic rebrand, Tata uses Vistara’s superior service, operational efficiency, and premium appeal to modernise Air India’s image.

A single unified full-service airline prevents inefficiencies

Operating two full-service brands under one ownership would have been redundant. Merging operations under one entity reduces costs, overlaps, and brand confusion while strengthening market positioning.

How Tata Group is Managing the Transition

Unlike sudden rebrands that risk alienating customers, Tata has taken a phased approach to integrating Vistara into Air India. This ensures continuity, stability, and customer reassurance.

Here’s how they are making the transition smoother:

Gradual Brand Integration

Instead of an overnight shift, Tata carefully aligns Vistara’s service experience, operational efficiency, and premium positioning with Air India.

Service & Experience Overhaul

To ensure that Vistara’s premium experience isn’t lost, Tata implements better cabin interiors, enhanced in-flight services, and improved customer support under Air India’s name.

Loyalty Program Transition

Vistara’s loyal customers are being transitioned into Air India’s Flying Returns loyalty program to retain and engage premium passengers.

Maintaining Customer Trust

Public communication and transparent messaging are key to ensuring that Vistara’s customers feel reassured that their valued quality will be reflected in Air India.

Key Takeaways

If phasing out a brand, preserve its strongest elements

A merger isn’t just about keeping a name, it’s about retaining what customers love most. By incorporating Vistara’s premium service standards, inflight experience, and operational efficiency, Air India is signaling improvement rather than just consolidation.

A legacy brand requires service and cultural transformation

Reviving a legacy brand like Air India requires more than just a logo refresh, it demands fundamental improvements in service quality, operational excellence, and employee culture.

Strategy 2: Merging Two Brand Names for a Hybrid Identity

Case Study: Disney + JioCinema

In the fast-evolving world of digital entertainment, mergers and partnerships often define how consumers access and engage with content. In 2024, Disney and Reliance’s Jio announced a strategic merger combining their streaming and media assets, creating an entertainment powerhouse that brings together global premium content and India’s largest digital distribution network.

Instead of Disney outright acquiring JioCinema or Jio rebranding Disney+ Hotstar, the two brands have adopted a hybrid branding approach, one that leverages the strengths of both identities without alienating existing audiences.

Why This Strategy?

Disney provides premium global content.

Disney’s content library, which includes Marvel, Star Wars, Pixar, and National Geographic, is a global force in entertainment. However, despite its brand equity, it needed more substantial local distribution and engagement in India, where Jio dominates.

Jio dominates India’s digital distribution and local entertainment landscape.

JioCinema has emerged as India’s fastest-growing streaming platform, gaining immense traction after acquiring IPL broadcasting rights. Its strength lies in mass reach, affordability, and localised entertainment, making it an ideal vehicle for Disney’s premium content.

A hybrid brand reassures both sets of customers.

A sudden shift, either completely rebranding JioCinema as Disney+ or eliminating Disney’s presence in favor of Jio, could have created confusion or alienate existing users. A hybrid identity preserves recognition for both audiences, ensuring a smoother transition.

How the Transition is Being Managed

Unlike a complete acquisition, where one brand disappears, a hybrid merger requires careful integration. The goal is to blend global appeal with local relevance, ensuring both brands retain their core identities while benefiting from shared infrastructure and content access.

Here’s how this merger is unfolding:

Unified Content Strategy

The new entity is expected to offer a seamless experience rather than separating international and local content. It will allow users to access Disney’s premium library alongside Jio’s Bollywood, regional, and sports content.

Flexible Monetization Models

JioCinema and Disney+ Hotstar have historically operated on different subscription models. The new brand may introduce a hybrid revenue strategy, featuring:

- Ad-supported tiers (for broader audience reach).

- Premium subscriptions (for exclusive global content).

- Sports-centric packages (leveraging IPL and Disney’s ESPN content).

Localised Brand Messaging

While Disney has strong global recognition, Jio has an undeniably more substantial local footprint in India. Marketing campaigns must balance Disney’s aspirational, family-friendly storytelling with Jio’s mass-market, mobile-first digital ecosystem.

Key Takeaways

Hybrid branding maintains audience trust while signaling evolution.

By merging names instead of eliminating one brand, Disney and Jio ensure that users feel continuity, reducing the risk of brand confusion or customer churn.

A well-balanced name merger prevents brand identity conflicts.

A name like JioHotstar allows both brands to retain their core identity while signaling a more significant, integrated entertainment ecosystem.

Strategy 3: Keeping Multiple Brands Separate Under One Umbrella

Case Study: Marriott + Starwood

When two companies merge, the instinctive response is often to unify them under a single brand. However, in some industries, brand identity and customer perception are so distinct that a complete rebrand could erode trust and alienate loyal customers.

The hospitality industry is a prime example of this challenge. Travelers develop strong affinities with hotel brands, associating them with a particular level of service, amenities, and prestige. A frequent guest at The Westin or St. Regis might not feel the same connection to a Marriott-branded property, even though Marriott owns both brands.

That’s why when Marriott acquired Starwood Hotels in 2016, it made a critical decision, instead of consolidating everything under the Marriott name, it retained the distinct branding of Starwood’s hotels while integrating operations behind the scenes.

This approach allowed both brands to maintain their market positioning, while Marriott benefited from operational efficiencies and economies of scale.

Why This Strategy?

Each hotel brand caters to distinct traveler segments.

Marriott had a broad portfolio ranging from luxury properties (Ritz-Carlton, JW Marriott) to business-friendly brands (Courtyard, Fairfield Inn). On the other hand, Starwood had upscale lifestyle brands like W Hotels, Westin, and Sheraton, which appealed to a different clientele.

By keeping Starwood’s brands separate, Marriott retained the unique value propositions that customers associated with each chain.

Preserving brand identity maintains customer trust.

For frequent travelers who were strongly loyal to Starwood brands, a sudden rebrand could have led to customer dissatisfaction and defection to competitors like Hilton or Hyatt.

Instead, Marriott kept the brand names intact and allowed customers to continue booking under their preferred brands while enjoying the benefits of a larger loyalty program.

Operational efficiencies are achieved through shared systems.

While the front-facing brands remained distinct, Marriott integrated backend systems, reservation technology, and loyalty programs to improve efficiency.

This helped streamline operations while allowing hotels to maintain their independent brand identities.

How Marriott Managed the Transition

Unlike mergers where one brand overtakes another, Marriott took a measured approach to integrating Starwood. The focus was on unifying backend operations while keeping customer-facing branding intact.

Loyalty Program Integration

One of the biggest challenges was merging Marriott Rewards and Starwood Preferred Guest (SPG), both of which had strong followings. Instead of forcing one program to disappear, Marriott developed Marriott Bonvoy, which combined the best elements of both. This allowed guests to retain their points, status, and benefits without feeling like they lost out.

Technology & Booking Systems Unification

While brands remained distinct, Marriott transitioned all Starwood properties to its centralised booking platform and CRM system. This streamlined reservation management, improved customer data insights, and enhanced operational efficiency.

Maintaining Brand Differentiation in Marketing

Even after the merger, Marriott and Starwood brands continue to market separately.

- Westin still promotes its wellness experience.

- W Hotels continues to focus on bold, modern luxury.

- Sheraton retains its international business appeal.

This prevents customer confusion while allowing Marriott to capture a broader market across different traveler demographics.

Key Takeaways

Separate brands can thrive under one corporate umbrella if managed strategically.

If brands have loyal, distinct customer bases, maintaining their identity can prevent alienation while benefiting from shared corporate resources.

A strong backend integration can drive efficiency while preserving differentiation.

Merging operations, loyalty programs, and technology infrastructure enhances cost savings and customer convenience without erasing what made each brand unique.

By keeping its acquired brands separate yet operationally unified, Marriott successfully expanded its market dominance without alienating customers, a lesson from which other industries, from retail to financial services, can learn.

Strategy 4: Creating an Entirely New Brand

Case Study: Vodafone + Idea = Vi

When two brands merge, the obvious choices are usually absorbing one into the other or maintaining separate identities under a single corporate umbrella. But what if neither brand is strong enough to dominate? What if both carry legacy challenges that could weigh down the merged entity?

In such cases, companies often choose to wipe the slate clean and create an entirely new brand, one that allows them to reset market perceptions, unify their customer base, and signal a fresh beginning.

This happened when Vodafone and Idea merged to form Vi in 2020.

Why This Strategy?

The Indian telecom sector is one of the most competitive markets in the world, with dominant players like Reliance Jio and Bharti Airtel reshaping consumer expectations for affordability, network speed, and digital-first services. When Vodafone India and Idea Cellular merged, they faced several challenges:

A fresh start allowed the company to reset customer perceptions.

Both Vodafone and Idea had strong regional presences, but neither had the dominance to challenge Reliance Jio or Airtel outright.

Vodafone was considered premium but expensive, while Idea was perceived as affordable but limited in network reach.

Instead of favoring one brand, they created Vi, signaling a fresh start and a unified identity.

A new brand positioned Vi as a digital-first telecom provider.

Vi was not just a combination of Vodafone and Idea—it was launched as a modern, digital-first brand that aimed to shed legacy challenges and align with India’s rapidly evolving telecom landscape.

The rebrand was built around a tech-savvy, youthful image, positioning Vi as a future-ready network for consumers and businesses.

It avoided customer confusion by creating a single, unified identity.

Had they kept Vodafone and Idea alive, there would have been overlapping marketing, operational inefficiencies, and potential customer churn.

Creating Vi as a unified brand streamlined customer experience and prevented unnecessary competition within the merged company.

How Vodafone & Idea Managed the Rebrand

Unlike a gradual transition where a smaller brand is absorbed into a dominant one, the Vodafone-Idea merger required an immediate shift to a new identity.

New Brand Identity & Visual Language.

The Vi brand was created from scratch, with a modern, vibrant visual identity, distinct from Vodafone’s red-heavy branding and Idea’s yellow-blue colors.

Strong Launch Campaign to Drive Awareness.

The Vi rebrand was accompanied by an aggressive marketing campaign to introduce the new identity, ensuring that customers recognised the transition and understood its meaning.

Network Consolidation & Service Improvements.

Beyond just a name change, Vodafone Idea worked on network integration, promising better coverage and enhanced service quality. This helped legitimize the rebrand by offering tangible benefits to customers.

Customer Reassurance & Transition Strategy.

Rather than alienating existing customers, Vi kept Vodafone and Idea subscribers engaged, allowing them to continue using services seamlessly under the new brand.

Key Takeaways

A fresh brand can offer a clean break from past challenges

For brands with legacy issues or negative perceptions, a complete rebrand can be an opportunity to change the narrative and reposition themselves in the market.

A new brand must come with a well-communicated value proposition

Simply launching a new name isn’t enough—companies must clearly define what the new brand stands for and how it improves on the previous identities.

By reinventing itself as Vi, Vodafone Idea avoided the confusion of dual branding and positioned itself as a refreshed, competitive player in India’s telecom space.

Final Thoughts: How to Choose the Right Branding Strategy

Rebranding after a merger is not just a marketing exercise, it’s a business decision that influences customer loyalty, market perception, and company culture.

When two companies merge, customers don’t just see a business deal, they see a change in the brand they’ve trusted. If that change is disruptive, confusing, or handled poorly, it can lead to customer disengagement, employee dissatisfaction, and market erosion.

The most successful mergers are the ones that:

- Respect the legacy of both brands while embracing the future.

- Prioritise customer trust over corporate ego.

- Communicate the transition clearly and transparently.

Whether absorbing a brand, merging names, keeping them separate, or creating something entirely new, branding strategy must align with business objectives, market perception, and long-term vision.

At the heart of every successful brand transition is a simple truth: People connect with brands emotionally. A merger isn’t just about combining assets, it’s about blending identities in a way that reassures, excites, and retains trust.

At the heart of every successful brand transition is a simple truth: People connect with brands emotionally. A merger isn’t just about combining assets, it’s about blending identities to reassure, excite, and retain trust.

©2023 Rato Communications. All Rights Reserved.